Roi calculation methods

Are There Different Methods of Calculating Return on Investment. However from pmp exam point of view it is not mandatory to know all the calculation steps of.

Return On Investment Definition Formula Roi Calculation

Competitor analysis is one of the reasons why ROMI calculation should be taken.

. The ROI calculation is a standard financial equation developed through finance and economics. Others include return on investment ROI the debt-to-equity ratio and earnings per share EPS. Alongside other simple measures of profitability NPV IRR payback period ROI is one of the most frequently used methods of evaluating the economic consequences of an.

Use metrics from quantitative research to demonstrate value. The following table compares the results of the different methods applied to this example. Create an impact study to calculate training ROI.

Just divide the numerator value by the denominator value. ROI is arguably the most popular metric to use when comparing the attractiveness of one IT investment to another. However in practice determining the value of an income-generating property with these.

Measuring UX and ROI. Sales Market share Customer feedback. The value per share of PQR Ltd is 700.

Top 18 Best Competitor. Since 1934 Perrys Chemical Engineers Handbook has delivered unrivaled state-of-the-art coverage of all aspects of chemical engineeringfrom the fundamentals to details on computer applications and control. Return on investment ROI measures how effectively a business uses its capital to generate profit.

Quantitative benchmarking of digital experiences offers many benefits to UX practitioners including the ability to. All methods respect the available balance configuration as explained below. If you have a calculator then there is a simple tricks to instantly transform any fraction to a decimal.

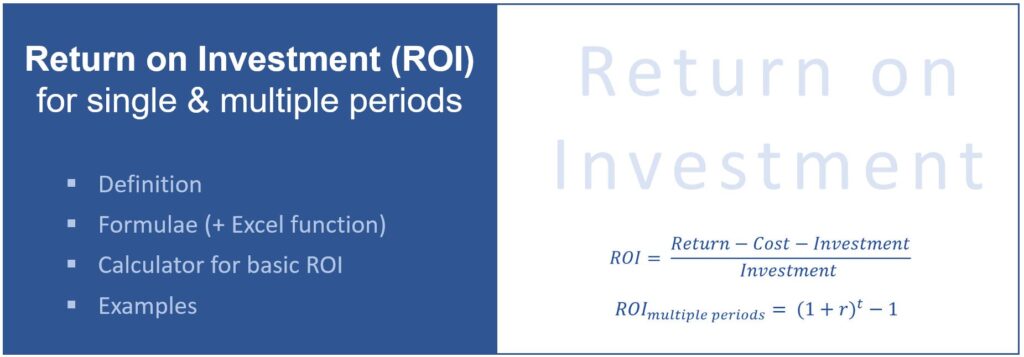

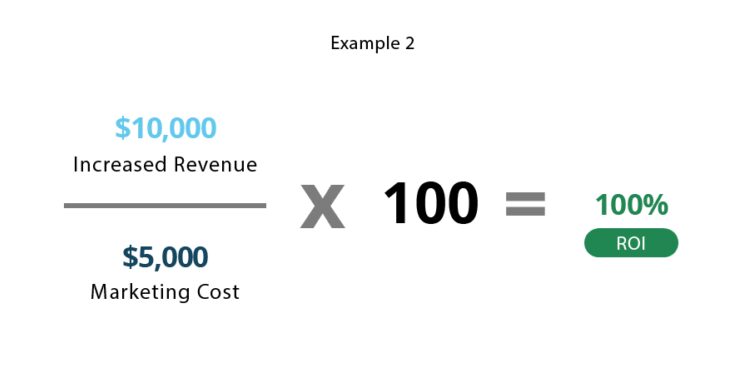

ROI multiple periods cumulative return over all periods r return per period in the equation needs to be solved for r t number of periods. Typically it is used in determining whether a project will yield a positive payback and have value for the business. For the purposes of this article ROI is an indicator used to measure the financial gainloss or value of a project in relation to its cost.

How to Calculate. In finance return is a profit on an investment. Jeff spends time traveling and with his family writing this blog managing his real estate portfolio of apartment buildings overseeing his investment portfolio investigating angel investments coaching other entrepreneurs and managing his private equity holdings.

4 Methods to Calculate Return on Investment. Track improvements of the experience over time. Just divide the numerator value by the denominator value.

Have the right data collection and reporting methods in place as well. Determine whether or not design changes are having a positive impact on the experience. The calculation can also be an indication of how an investment has performed to date.

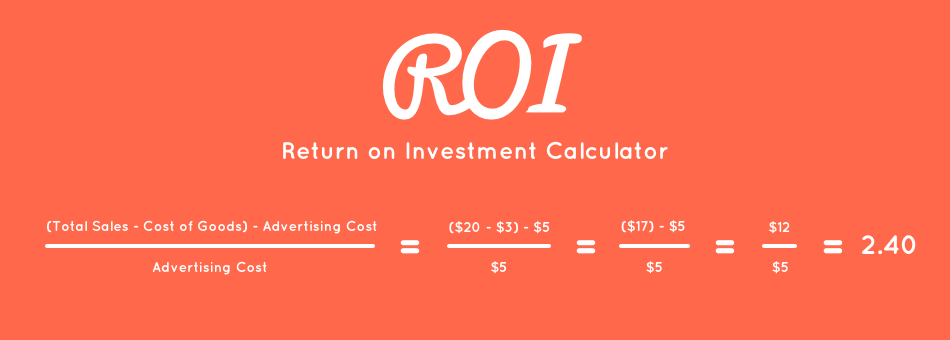

It comprises any change in value of the investment andor cash flows or securities or other investments which the investor receives from that investment such as interest payments coupons cash dividends stock dividends or the payoff from a derivative or structured productIt may be measured either in absolute terms eg. You can use one or more of four ROI calculation methods. Comparison of NPV BCR PBP ROI and IRR Results.

Refer to the dedicated articles on each of these indicators for the respective illustrated step-by-step calculation. ROI 13125 - 7500 7500 X 100 75. If you have a calculator then there is a simple tricks to instantly transform any fraction to a decimal.

To conversion Fraction to Decimal mainly there are two methods available Those are- 1. Configuring amount per trade There are several methods to configure how much of the stake currency the bot will use to enter a trade. The simplest ROI formula is as follows.

To conversion Fraction to Decimal mainly there are two methods available Those are- 1. Payback net present value internal rate of return and profitability index. Compare your experience against your.

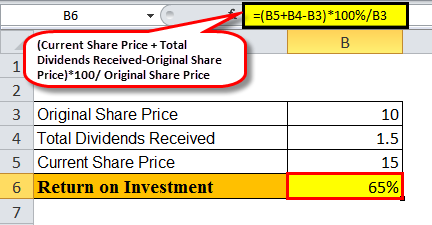

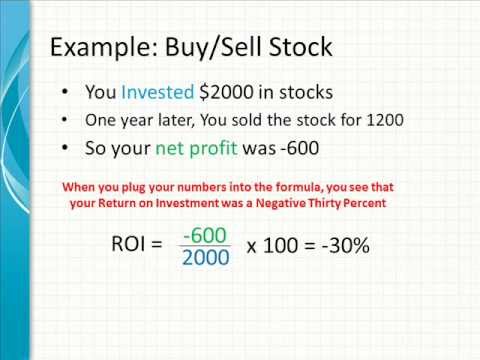

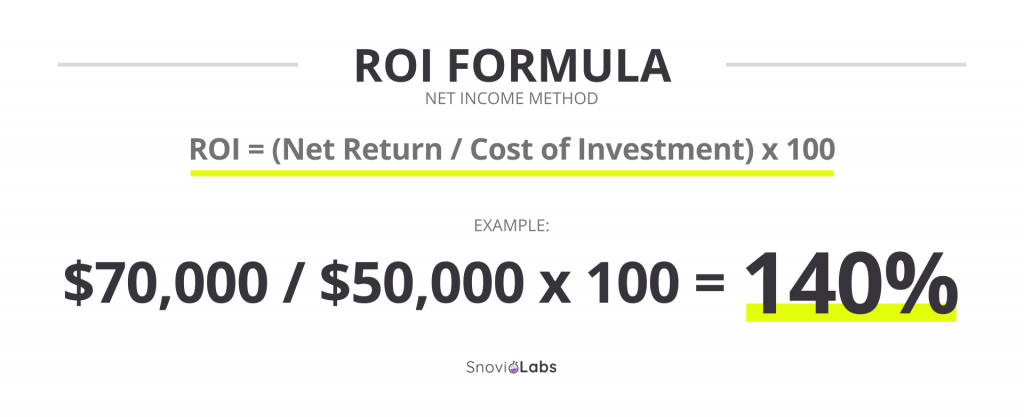

ROI calculations are simple and help an investor decide whether to take or skip an investment opportunity. The rental property ROI calculation can generally take two forms depending on whether you purchase your property with cash or finance it with debt. Now let us the calculation of the ROI formula with the below methods-1 Net Income Method.

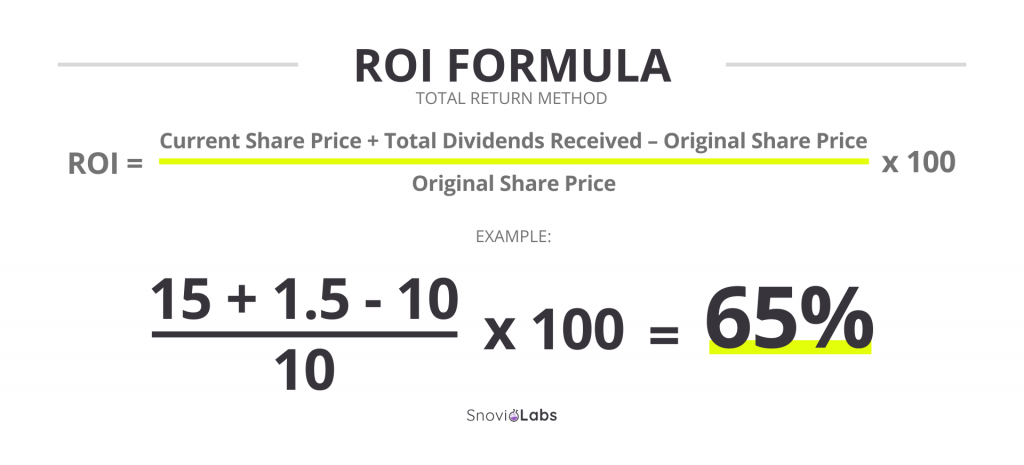

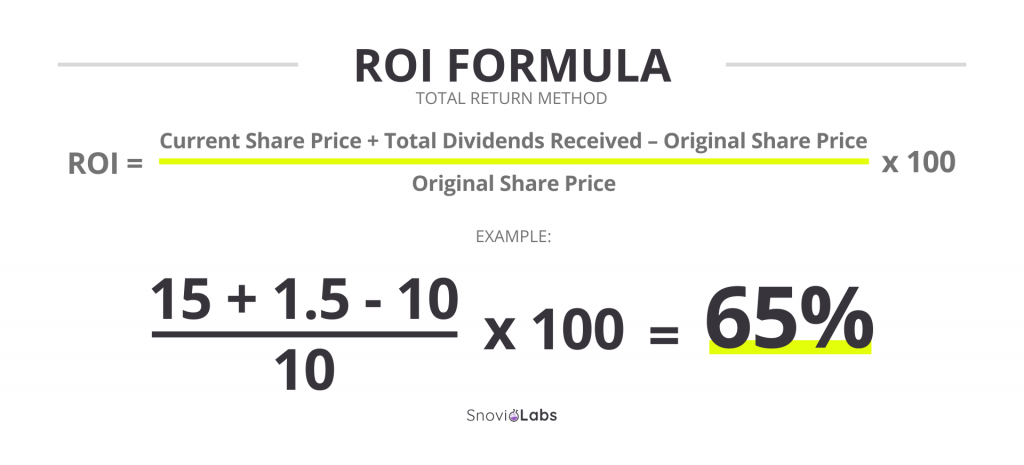

While comparing ROI of different companies it is necessary that the companies use similar accounting policies and methods in respect of valuation of stocks valuation of fixed assets apportionment of overheads treatment of research and development expenditure etc. Now for calculation of Total Return and of Total Return the following steps are to be taken. 52219100000 100 5222.

Net income capital gain total return and. Thus when a calculation returns a result of ROI 01 the financial analysts report it as the ROI 10. Total Return Formula Example 2.

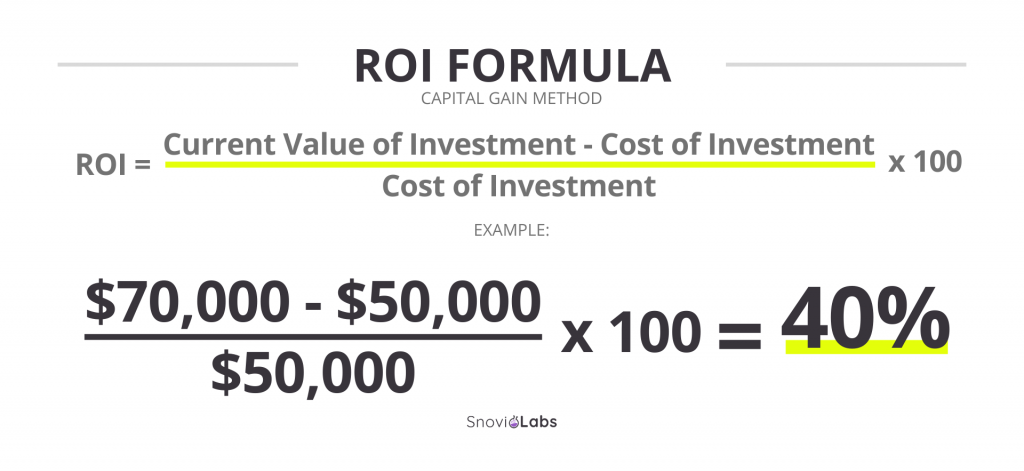

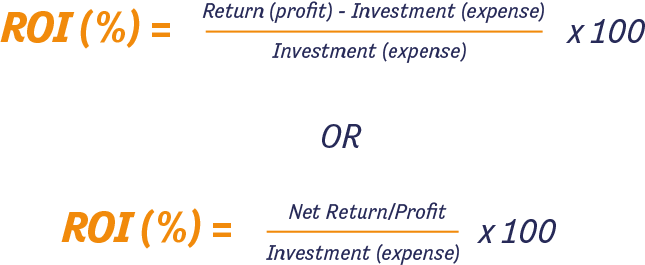

You can calculate ROI by dividing net profit current value of investment - cost of investment by the cost of investment. See above to use our simple ROI calculator for rental property. We are proud to use their methods and tools in our courses to allow our learners to obtain ROI certification as part of our masters and doctoral programs in Training and Performance Improvement.

The results will tell you whether the. As mentioned above the project selection methods list is quite exhaustive. Roadblocks to Real Estate Valuation.

Constrained Optimized Methods Linear Programming. Customarily ROI is presented in the form of percentage points. The first component of this formula is similar to the future value formula FV 1rt solved for r.

This is the final step. Return on Investment ROI Murder Board. Depending on the industry there are multiple interpretations of ROI.

Value of 9 Debentures is 90000. If your goals. ROI Net.

Free cash flow is just one metric used to gauge a companys financial health. Jeff sold his company to private equity in 2017 and is now semi-retired. The ROI of the training could be expressed as 75.

A business impact is any change brought about by the training. The calculation will differ significantly depending on the property and funding methods. The third easy way of calculating ROI is to create an impact study.

Return on Marketing Investment ROMI also called Marketing ROI or mROI is a method of measuring the return on investment. The Use of the ROI Formula Calculation. The higher the ROI the better.

There are a total of four methods to calculate return on investment calculation. Lets assume each of these scenarios. Both of these real estate valuation methods seem relatively simple.

The definitive reference for more than half a centuryupdated for the first time in more than a decade. While the basic ROI formula can be used in a number of situations variations can be used for other. ROI formula Net Income Investment value 100.

The calculator covers four different ROI formula methods. BCR Program Benefits Program Costs.

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

Elearning Roi What It Is And How To Measure It In 2022

What Is Roi Definition Formulas And Tips Snov Io

Return On Investment Definition Formula Roi Calculation

Return On Investment Analysis For An Investor Plan Projections

How To Calculate Roi Youtube

The Roi Formula How To Calculate It And Why Your Marketing Needs It Dashly Blog

Calculating Return On Investment Roi In Excel

What Is Roi Definition Formulas And Tips Snov Io

Roi Estimation Planning

What Is Roi Definition Formulas And Tips Snov Io

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

What Is Roi Workana

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Roi Formula And Calculator Excel Template

Return On Investment Roi Definition Equation How To Calculate It